Wednesday 28 December 2011

HDFC's Deepak Parekh resigns from HUL board

FMCG major Hindustan Unilever Ltd (HUL) today said HDFC Ltd Chairman Deepak Parekh, who is an independent director in the company's board has resigned after more than 14 years of association with the firm citing personal reasons.

Parekh, who was on the company's board since 1997, resigned after putting in more than 14 years in the firm, HUL said in a filing to the BSE.

Parekh, who was on the company's board since 1997, resigned after putting in more than 14 years in the firm, HUL said in a filing to the BSE.

RBI to issue 500 note with rupee symbol

The Reserve Bank will shortly issue Rs 500 notes which will have the rupee symbol. The Rs 500 notes will be of the Mahatma Gandhi-2005 Series bearing the signature of Reserve Bank of India (RBI) governor D Subbarao and with the year of printing mentioned on the back of the banknote, the apex bank said in a statement.

The design of the notes to be issued is similar in all respects to the existing Rs 500 in Mahatma Gandhi Series-2005 issued earlier, except for the rupee symbol.However, all the banknotes in the denomination of Rs 500 issued by the RBI in the past will continue to be legal tender.

Last month, the RBI had announced that it will soon introduce notes of Rs 1,000, Rs 100 and Rs 10 denomination featuring the rupee symbol.

The design of the notes to be issued is similar in all respects to the existing Rs 500 in Mahatma Gandhi Series-2005 issued earlier, except for the rupee symbol.However, all the banknotes in the denomination of Rs 500 issued by the RBI in the past will continue to be legal tender.

Last month, the RBI had announced that it will soon introduce notes of Rs 1,000, Rs 100 and Rs 10 denomination featuring the rupee symbol.

Stock Trading Tips for 29 Dec 2011

Stock Trading Tips for 29 Dec 2011

| Scrip | Trigger | Price | Stop Loss | Target 1 |

|---|---|---|---|---|

| AANJANEYA | BUY ABOVE | 510 | 506 | 520 |

| SELL BELOW | 500 | 505 | 490 | |

| WIPRO | BUY ABOVE | 401 | 397 | 410 |

| SELL BELOW | 393 | 396 | 385 |

Monday 26 December 2011

Stock Trading Tips for 27 Dec 2011

Stock Trading Tips for 27 Dec 2011

| Scrip | Trigger | Price | Stop Loss | Target 1 |

|---|---|---|---|---|

| CANBK | BUY ABOVE | 370 | 367 | 382 |

| SELL BELOW | 363 | 366 | 353 | |

| FINANTECH | BUY ABOVE | 565 | 560 | 580 |

| SELL BELOW | 554 | 559 | 546 |

Sunday 25 December 2011

CRISIL assigned grade 4/5 to MT Educare IPO

CRISIL Research has assigned a grade 4/5 to the proposed initial public offer (IPO) of MT Educare Limited, which indicates that the fundamentals of the IPO are above average relative to the other listed equity securities in India.

According to the report, however, this grade is not an opinion on whether the issue price is appropriate in relation to the issue fundamentals. The grade is not a recommendation to buy, sell or hold the graded instrument, or a comment on the graded instrument’s future market price or its suitability for a particular investor.

"The assigned grade reflects the company’s strong brand resulting from its established track record and dominant position in Mumbai coaching industry. The grade also factors in the expected healthy growth in the industry in Maharashtra - at a CAGR of 11.6% to Rs 51 bn in FY15. MT Educare currently runs 190 centers across Maharashtra, Karnataka, Gujarat and Tamil Nadu. It has undertaken a major expansion in the number of centers during FY09 but these are yet to reach optimum utilisation. MT Educare, being a branded and one of the largest players, with the support of its underutilized infrastructure, is well placed to benefit from the expected Maharashtra-wide growth. The grade is also supported by the company’s diverse product portfolio and process driven operations which ensure quality and efficient use of the infrastructure as well as help to retain existing students. The grade is also supported by the execution capabilities of the management."

The report says, "The grade is moderated by the company’s over dependence on Mumbai from where it derives a major portion of its revenue – this poses a geographical concentration risk. It is also moderated by the intense competition offered by the highly unorganised industry which could narrow down the company’s growth. Further, being cash rich, its future acquisitions and their merger with MT Educare remains a key monitorable."

"MT Educare’s revenue growth in the past three years has been driven by the capacity expansion in FY09 and increase in its utilisation, thereon. The increasing trend of the EBITDA margin is also explained by its increasing capacity utilisation. It has reported an EPS of Rs 2.8 for 9MFY11. The company is debt free as on 9MFY11," according to the report.

According to the report, however, this grade is not an opinion on whether the issue price is appropriate in relation to the issue fundamentals. The grade is not a recommendation to buy, sell or hold the graded instrument, or a comment on the graded instrument’s future market price or its suitability for a particular investor.

"The assigned grade reflects the company’s strong brand resulting from its established track record and dominant position in Mumbai coaching industry. The grade also factors in the expected healthy growth in the industry in Maharashtra - at a CAGR of 11.6% to Rs 51 bn in FY15. MT Educare currently runs 190 centers across Maharashtra, Karnataka, Gujarat and Tamil Nadu. It has undertaken a major expansion in the number of centers during FY09 but these are yet to reach optimum utilisation. MT Educare, being a branded and one of the largest players, with the support of its underutilized infrastructure, is well placed to benefit from the expected Maharashtra-wide growth. The grade is also supported by the company’s diverse product portfolio and process driven operations which ensure quality and efficient use of the infrastructure as well as help to retain existing students. The grade is also supported by the execution capabilities of the management."

The report says, "The grade is moderated by the company’s over dependence on Mumbai from where it derives a major portion of its revenue – this poses a geographical concentration risk. It is also moderated by the intense competition offered by the highly unorganised industry which could narrow down the company’s growth. Further, being cash rich, its future acquisitions and their merger with MT Educare remains a key monitorable."

"MT Educare’s revenue growth in the past three years has been driven by the capacity expansion in FY09 and increase in its utilisation, thereon. The increasing trend of the EBITDA margin is also explained by its increasing capacity utilisation. It has reported an EPS of Rs 2.8 for 9MFY11. The company is debt free as on 9MFY11," according to the report.

Reviewing entire IPO process

From the Takeover Code to the initial public offering (IPO) review process, SEBI chairman UK Sinha has his plate full.Sinha says that some changes have been made to the IPO review process, but a complete review would take sometime.

He, however, added that policy action on IPO listing-day trades would be taken very soon.Sinha says, “We are looking at a review for entire IPO process, who would participate, in what manner he should participate and how to reduce the timelines."

He further says, the question about how the volatility on the listing day can be handled is also attracting the attention. "We have not yet found the causes. We hope to do it very soon.”

Sinha says, “There is a misconception in the minds of people that while SEBI has allowed FIIs, it also has allowed sub-account and participatory notes. There is a belief or suspicion that a lot of Indian money might be coming through that route. I would like to clarify the position that a very strong KYC is done whenever any participatory note is issued.”

He further says, percentage of money coming in through participatory notes has come down substantially. “If in 2007, it was 50%. My guess is it has now come down to 15-16%.”

He, however, added that policy action on IPO listing-day trades would be taken very soon.Sinha says, “We are looking at a review for entire IPO process, who would participate, in what manner he should participate and how to reduce the timelines."

He further says, the question about how the volatility on the listing day can be handled is also attracting the attention. "We have not yet found the causes. We hope to do it very soon.”

Sinha says, “There is a misconception in the minds of people that while SEBI has allowed FIIs, it also has allowed sub-account and participatory notes. There is a belief or suspicion that a lot of Indian money might be coming through that route. I would like to clarify the position that a very strong KYC is done whenever any participatory note is issued.”

He further says, percentage of money coming in through participatory notes has come down substantially. “If in 2007, it was 50%. My guess is it has now come down to 15-16%.”

IPO for Maiam Global Foods plans

Maiam Global Foods has filed draft red herring prospectus with market regulator for initial public offering of upto 90 lakh equity shares of face value of Rs 10 each - a dilution of 49.70% stake.

The company is engaged in the business of trading and processing of agro products such as pulses, spices and edible oil. It is also engaged in to business of agriculture through cultivation, processing and distribution of vegetables & fruits for commercial as well as captive use.

It ventured into restaurant business as well and operates three restaurants under the name "Jeevan Your Café" in and around Chennai.

Maiam intends to use issue money for setting up new restaurants (with an outlay of Rs 22.59 crore); development of green house cultivation (with cost of Rs 13.75 crore); strengthening supply chain management (at cost of Rs 4.81 crore); modernization of plant & machinery for processing of pulses and spices (with Rs 1.85 crore); and for working capital requirements (Rs 13 crore).

For the quarter ended on June 30, 2011, the company reported a net profit of Rs 2.65 crore on total income of Rs 29.81 crore. For the financial year ended on March 31, 2011, it had reported profit of Rs 3.14 crore on total income of Rs 89.33 crore.

The company is engaged in the business of trading and processing of agro products such as pulses, spices and edible oil. It is also engaged in to business of agriculture through cultivation, processing and distribution of vegetables & fruits for commercial as well as captive use.

It ventured into restaurant business as well and operates three restaurants under the name "Jeevan Your Café" in and around Chennai.

Maiam intends to use issue money for setting up new restaurants (with an outlay of Rs 22.59 crore); development of green house cultivation (with cost of Rs 13.75 crore); strengthening supply chain management (at cost of Rs 4.81 crore); modernization of plant & machinery for processing of pulses and spices (with Rs 1.85 crore); and for working capital requirements (Rs 13 crore).

For the quarter ended on June 30, 2011, the company reported a net profit of Rs 2.65 crore on total income of Rs 29.81 crore. For the financial year ended on March 31, 2011, it had reported profit of Rs 3.14 crore on total income of Rs 89.33 crore.

IPO-Bluplast Industries files DRHP for Rs 60-cr

Bluplast (with an outlay of Rs 39.74 crore) is setting up additional manufacturing facility for the manufacturing of plastic injection moulding products with an installed capacity of 7,900 MTPA in and around Vapi, Bhilad and Pradi, Distt. Valsad, Gujarat. It is also diversifying by setting up a manufacturing facility for the production of non-stick cookware and pressure cookers. Its proposed capacity is 6,000 units per day for non-stick cookware and 1,500 units per day for pressure cookers.

The company also wants to spend Rs 5.53 crore for brand building. It plans Rs 10 crore for additional working capital requirements.For the period of seven months ended on October 31, 2011, the company reported a net profit of Rs 2.01 crore on total income of Rs 102.88 crore. For the financial year ended on March 31, 2011, it had reported profit of Rs 85.17 lakh on total income of Rs 134.13 crore.

Bluplast Industries is engaged in the manufacturing and marketing of plastic thermoware, vacuumware, insulatedware, kitchenware, household, utility and PET products. It sells its products under the brand name “Bluplast” and has has a current installed capacity of 12,100 MTPA.

The company also wants to spend Rs 5.53 crore for brand building. It plans Rs 10 crore for additional working capital requirements.For the period of seven months ended on October 31, 2011, the company reported a net profit of Rs 2.01 crore on total income of Rs 102.88 crore. For the financial year ended on March 31, 2011, it had reported profit of Rs 85.17 lakh on total income of Rs 134.13 crore.

Bluplast Industries is engaged in the manufacturing and marketing of plastic thermoware, vacuumware, insulatedware, kitchenware, household, utility and PET products. It sells its products under the brand name “Bluplast” and has has a current installed capacity of 12,100 MTPA.

Union Budget to be delayed by a week due to polls

The Union Budget is likely to be delayed by a few days, government sources have said.

The Union budget and Railway budget are likely to be tabled in the first week of March, they said.

That's only after assembly elections in five states – Uttar Pradesh, Punjab, Uttarakhand, Goa and Manipur - are over.

Earlier it was reported that Finance Minister Pranab Mukherjee will present the Union Budget on February 29, a day after the final phase of polling in Uttar Pradesh.

It was expected that the final phase of UP elections would have an impact on the Union budget and that it might be deferred to a later date.

The elections in Uttar Pradesh will be held in seven phases on February 4, 8, 11, 15, 19, 23 and 28 while the polling will be done in Punjab and Uttarakhand on January 30.

Manipur will be the first to vote on January 28 whereas the elections in Goa will be held on March 3.

The Union budget and Railway budget are likely to be tabled in the first week of March, they said.

That's only after assembly elections in five states – Uttar Pradesh, Punjab, Uttarakhand, Goa and Manipur - are over.

Earlier it was reported that Finance Minister Pranab Mukherjee will present the Union Budget on February 29, a day after the final phase of polling in Uttar Pradesh.

It was expected that the final phase of UP elections would have an impact on the Union budget and that it might be deferred to a later date.

The elections in Uttar Pradesh will be held in seven phases on February 4, 8, 11, 15, 19, 23 and 28 while the polling will be done in Punjab and Uttarakhand on January 30.

Manipur will be the first to vote on January 28 whereas the elections in Goa will be held on March 3.

DRL, Zuari Ind, IRB Infra, GVK Power, RIL : Stocks News

Government sources

-General budget to be presented on February 29, 2012

-UP election schedule will not impact general budget

-UP elections end on February 28, 2012

TDSAT hearing dot to file reply by next Saturday

-TDSAT stays DoT 3G roaming ban order

-No coercive steps to be taken against companies until order

-TDSAT to hear matter on January 3

Telcos to TDSAT

-Decision to ban 3G intra circle roaming arbitrary

-Not issued showcause notice; no hearing given

-5 telcos paid around Rs 67,000 crore for 3G spectrum

-5 telcos include Airtel , Vodafone, Idea , Tata & Aircel

-DoT said intra circle roaming governed by license

-Telecom license contemplates intra circle roaming

-2008 roaming policy permits intra circle roaming

-Auction held for 3G spectrum, not for license

-No separate 2G & 3G license

-Holding telecom license was prerequisite for 3G bidding

-Telecom license is tech neutral; allows all services

-There is one pan-india telecom license.

Other stocks and sectors that are in news today:

IIFCL may get Rs 10 billion fund infusion soon: ET

REC firms up plan to raise up to USD 600 million through FCCBs:

MintOil Ministry to cap RIL 's spend on developing new KG-D6 gas fields: ET -New telecom policy regime likely by June 2012: Ministry: ET

FCCB payout may put pressure on Reliance Communications for tower stake sale: ETOil marketing companies (OMCs) may raise petrol prices by Re 1/litre next monthGVK Power : Changi to buy 26% in company’s airport business for Rs 2200 crore

Tech Mahindra : BT Group to wait for Tech Mahindra-Satyam merger before stake sale IRB Infra : NHAI terminates concession agreement of four laning of Goa/ Karnataka border to Panaji Zuari Industries :

To buy rock phosphate Latin American mine through a JV with Japan’s Mitsubishi

Mastek : Bombay HC approves scheme of amalgamation of Keystone Solutions Pvt Limited with Mastek

SBI , BoB to raise NRE Deposit rates: BS

Maharashtra Govt refuses aid to sugar mills seeking fixed cane purchase, export grant

Coal Ministry gives go-ahead to new pricing mechanism to bring Indian coal prices at par with international prices

Power producers not selling electricity at regulated prices should not get gas supply: Petroleum Ministry

Dabur to write off Rs 45 crore loss of fully owned retail subsidiary, H&B stores

3i Infotech plans to raise Rs 1,000 crore via securities

Monnet Ispat to buy back shares worth Rs 100 crore

Orissa Govt may clamp down on charges of illegal iron ore mining: ET - Dr Reddy ’s splits marketing division to boost domestic business: ET

Alfa Lava : Interim dividend Rs 30/share

F&O ban: ABG Shipyard, Gitanjali Gems, Ruchi Soya

-General budget to be presented on February 29, 2012

-UP election schedule will not impact general budget

-UP elections end on February 28, 2012

TDSAT hearing dot to file reply by next Saturday

-TDSAT stays DoT 3G roaming ban order

-No coercive steps to be taken against companies until order

-TDSAT to hear matter on January 3

Telcos to TDSAT

-Decision to ban 3G intra circle roaming arbitrary

-Not issued showcause notice; no hearing given

-5 telcos paid around Rs 67,000 crore for 3G spectrum

-5 telcos include Airtel , Vodafone, Idea , Tata & Aircel

-DoT said intra circle roaming governed by license

-Telecom license contemplates intra circle roaming

-2008 roaming policy permits intra circle roaming

-Auction held for 3G spectrum, not for license

-No separate 2G & 3G license

-Holding telecom license was prerequisite for 3G bidding

-Telecom license is tech neutral; allows all services

-There is one pan-india telecom license.

Other stocks and sectors that are in news today:

IIFCL may get Rs 10 billion fund infusion soon: ET

REC firms up plan to raise up to USD 600 million through FCCBs:

MintOil Ministry to cap RIL 's spend on developing new KG-D6 gas fields: ET -New telecom policy regime likely by June 2012: Ministry: ET

FCCB payout may put pressure on Reliance Communications for tower stake sale: ETOil marketing companies (OMCs) may raise petrol prices by Re 1/litre next monthGVK Power : Changi to buy 26% in company’s airport business for Rs 2200 crore

Tech Mahindra : BT Group to wait for Tech Mahindra-Satyam merger before stake sale IRB Infra : NHAI terminates concession agreement of four laning of Goa/ Karnataka border to Panaji Zuari Industries :

To buy rock phosphate Latin American mine through a JV with Japan’s Mitsubishi

Mastek : Bombay HC approves scheme of amalgamation of Keystone Solutions Pvt Limited with Mastek

SBI , BoB to raise NRE Deposit rates: BS

Maharashtra Govt refuses aid to sugar mills seeking fixed cane purchase, export grant

Coal Ministry gives go-ahead to new pricing mechanism to bring Indian coal prices at par with international prices

Power producers not selling electricity at regulated prices should not get gas supply: Petroleum Ministry

Dabur to write off Rs 45 crore loss of fully owned retail subsidiary, H&B stores

3i Infotech plans to raise Rs 1,000 crore via securities

Monnet Ispat to buy back shares worth Rs 100 crore

Orissa Govt may clamp down on charges of illegal iron ore mining: ET - Dr Reddy ’s splits marketing division to boost domestic business: ET

Alfa Lava : Interim dividend Rs 30/share

F&O ban: ABG Shipyard, Gitanjali Gems, Ruchi Soya

Petrol price may be hiked by Rs 1 next month

Petrol price may be hiked by about a rupee per litre from next month as the Indian currency has weakened against the US dollar making imports costlier.

The rate change may, however, need a political clearance as assembly elections in five crucial states, including Uttar Pradesh and Punjab, have been announced.

"While international price of gasoline (against which domestic petrol prices are benchmarked) are more or less at the same level (as at the time of last revision), the rupee has depreciated to about Rs 52.70 to a US dollar," a top official said.

The domestic rates, which were last revised on November 30, are pegged at Rs 51.50 to a US dollar exchange rate.

The average exchange rate in first fortnight of December was Rs 51.98 to a US dollar, which has further deteriorated.

State-owned oil companies like Indian Oil Corp (IOC) use fortnightly average of benchmark oil price and exchange rate to revise retail rates on 1st and 16th of every month.

The next review is due on December 31 and if the oil companies decide to pass on the exchange rate fluctuations to consumers, the new rates would be effective from January 1.

"There is an under-recovery of about 85 paise (Rs 0.85) per litre currently. After adding local sales tax, the desired increase in retail prices would be Rs 1.02 per litre," the official said.

Oil firms had, at the last review on December 15/16, decided not to burden the consumers with Rs 0.65-0.70 per litre hike in petrol price needed at that time, as they felt Reserve Bank's intervention may help arrest fall in rupee's value.

Petrol at IOC pumps in Delhi is currently priced at Rs 65.64 per litre and the rates vary by a couple of paise at the pumps of Bharat Petroleum and Hindustan Petroleum.

The oil firms had in November cut petrol prices twice on drop in international oil rates. The companies reduced petrol prices by Rs 2.22 per litre, or 3.2 per cent, from November 16, followed by a Rs 0.78 per litre cut from December 1.

However, it remains to be seen if the oil firms will get a political nod to increase the prices in view of assembly elections.Petrol price was freed from government control in June last year but public sector companies continue to informally consult their parent Oil Ministry before taking a decision.

The government continues to control rates of diesel, domestic LPG and kerosene which were sold way below cost to keep inflation under check. The oil firms lose Rs 12.95 per litre on diesel, Rs 29.99 a litre on kerosene and Rs 287 per 14.2-kg LPG cylinder.

The rate change may, however, need a political clearance as assembly elections in five crucial states, including Uttar Pradesh and Punjab, have been announced.

"While international price of gasoline (against which domestic petrol prices are benchmarked) are more or less at the same level (as at the time of last revision), the rupee has depreciated to about Rs 52.70 to a US dollar," a top official said.

The domestic rates, which were last revised on November 30, are pegged at Rs 51.50 to a US dollar exchange rate.

The average exchange rate in first fortnight of December was Rs 51.98 to a US dollar, which has further deteriorated.

State-owned oil companies like Indian Oil Corp (IOC) use fortnightly average of benchmark oil price and exchange rate to revise retail rates on 1st and 16th of every month.

The next review is due on December 31 and if the oil companies decide to pass on the exchange rate fluctuations to consumers, the new rates would be effective from January 1.

"There is an under-recovery of about 85 paise (Rs 0.85) per litre currently. After adding local sales tax, the desired increase in retail prices would be Rs 1.02 per litre," the official said.

Oil firms had, at the last review on December 15/16, decided not to burden the consumers with Rs 0.65-0.70 per litre hike in petrol price needed at that time, as they felt Reserve Bank's intervention may help arrest fall in rupee's value.

Petrol at IOC pumps in Delhi is currently priced at Rs 65.64 per litre and the rates vary by a couple of paise at the pumps of Bharat Petroleum and Hindustan Petroleum.

The oil firms had in November cut petrol prices twice on drop in international oil rates. The companies reduced petrol prices by Rs 2.22 per litre, or 3.2 per cent, from November 16, followed by a Rs 0.78 per litre cut from December 1.

However, it remains to be seen if the oil firms will get a political nod to increase the prices in view of assembly elections.Petrol price was freed from government control in June last year but public sector companies continue to informally consult their parent Oil Ministry before taking a decision.

The government continues to control rates of diesel, domestic LPG and kerosene which were sold way below cost to keep inflation under check. The oil firms lose Rs 12.95 per litre on diesel, Rs 29.99 a litre on kerosene and Rs 287 per 14.2-kg LPG cylinder.

Stock Trading Tips for 26 Dec 2011

Stock Trading Tips for 26 Dec 2011

| Scrip | Trigger | Price | Stop Loss | Target 1 |

|---|---|---|---|---|

| AXISBANK | BUY ABOVE | 888 | 800 | 912 |

| SELL BELOW | 771 | 779 | 758 | |

| ICICIBANK | BUY ABOVE | 729 | 721 | 742 |

| SELL BELOW | 714 | 720 | 700 |

Thursday 22 December 2011

Stock Trading Tips for 23 Dec 2011

Stock Trading Tips for 23 Dec 2011

| Scrip | Trigger | Price | Stop Loss | Target 1 |

|---|---|---|---|---|

| AMRUTANJAN | BUY ABOVE | 689 | 683 | 702 |

| SELL BELOW | 675 | 681 | 660 | |

| AXISBANK | BUY ABOVE | 882 | 874 | 900 |

| SELL BELOW | 864 | 872 | 852 |

Vodafone to discontinue services on inactive numbers

Faced with shortage of numbers, telecom major Vodafone India on Monday said it will discontinue services on mobile numbers of prepaid customers that have not been in use for a continuous period of 60 days.

'Vodafone India will discontinue mobile services for prepaid customers on numbers that have no usage i.e., no voice calls (incoming or outgoing), SMS and data for any continuous period of 60 days,' Vodafone said in a statement.

Vodafone's steps follow the guidelines by the Department of Telecom (DoT) for allocation of a new number series that based on subscribers on visitor location register (VLR). The Vodafone statement added that the stringent norms has created an acute shortage of numbers for any telecom company.

This means that after discontinuing services to the customer, Vodafone will be able to allocate the same number to a new user.

According to the data released by the Telecom Regulatory Authority of India (Trai), mobile subscriber base increased to 881.4 million by October-end from 873.61 million in the preceding month.

However, the number of active mobile subscribers, according to the visitor location register (VLR) data, during the month of was 626.18 million.

'Vodafone India will discontinue mobile services for prepaid customers on numbers that have no usage i.e., no voice calls (incoming or outgoing), SMS and data for any continuous period of 60 days,' Vodafone said in a statement.

Vodafone's steps follow the guidelines by the Department of Telecom (DoT) for allocation of a new number series that based on subscribers on visitor location register (VLR). The Vodafone statement added that the stringent norms has created an acute shortage of numbers for any telecom company.

This means that after discontinuing services to the customer, Vodafone will be able to allocate the same number to a new user.

According to the data released by the Telecom Regulatory Authority of India (Trai), mobile subscriber base increased to 881.4 million by October-end from 873.61 million in the preceding month.

However, the number of active mobile subscribers, according to the visitor location register (VLR) data, during the month of was 626.18 million.

Govt to spend on Economic Census

The government on Tuesday said it will spend Rs 800 crore for the Sixth Economic Census to be conducted from April to November 2012 to update the data on industrial activity across the country for better micro-level planning and policy formulation.

'The Ministry of Statistics and Programme Implementation has planned to spend Rs 800 crore for conducting the Sixth Economic Census as a Central Sector Plan Scheme during April to November, 2012', Statistics Minister Srikant Kumar Jena told reporters here.

The census would involve collection of data from entrepreneurial units in the country. The ministry will engage 8 lakh enumerators for the census, he added.

'The Ministry of Statistics and Programme Implementation has planned to spend Rs 800 crore for conducting the Sixth Economic Census as a Central Sector Plan Scheme during April to November, 2012', Statistics Minister Srikant Kumar Jena told reporters here.

The census would involve collection of data from entrepreneurial units in the country. The ministry will engage 8 lakh enumerators for the census, he added.

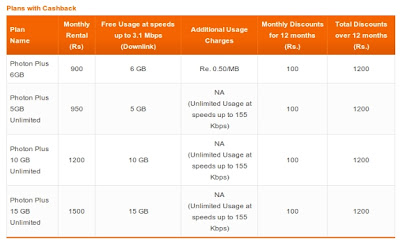

Tata Docomo has announced a price reduction on its wireless brandband service

Tata Teleservices Limited's unified brand Tata Docomo has announced a price reduction on its wireless brandband service, making it available at a price of Rs 1199.

This apart, new customers will get additional advantage of 100 per cent cash back offer on select plans. These customers will get a discount of Rs 100 on their monthly bill amount for the next 12 months making the device free.

In a press release, Rajan Gupta, chief operating officer, Tamilnadu circle, Tata Teleservices Limited, said, 'With Tata Docomo Photon Plus available at Rs 1199, I think customers will now have more power in their hands to make complete use of high speed internet connectivity anytime, anywhere that too at such an affordable cost.

This apart, new customers will get additional advantage of 100 per cent cash back offer on select plans. These customers will get a discount of Rs 100 on their monthly bill amount for the next 12 months making the device free.

In a press release, Rajan Gupta, chief operating officer, Tamilnadu circle, Tata Teleservices Limited, said, 'With Tata Docomo Photon Plus available at Rs 1199, I think customers will now have more power in their hands to make complete use of high speed internet connectivity anytime, anywhere that too at such an affordable cost.

Tuesday 20 December 2011

Stock Trading Tips for 21 Dec 2011

Stock Trading Tips for 21 Dec 2011

| Scrip | Trigger | Price | Stop Loss | Target 1 |

|---|---|---|---|---|

| KARURVYSYA | BUY ABOVE | 354 | 351 | 364 |

| SELL BELOW | 347 | 350 | 330 | |

| KOTAKBANK | BUY ABOVE | 449 | 445 | 460 |

| SELL BELOW | 440 | 444 | 430 |

Kingfisher Airlines violated tax rules

Cash-strapped carrier Kingfisher Airlines has not deposited with the government most of the income tax it deducted from its employees' salaries for the last two fiscal years, a government minister told lawmakers on Tuesday.

Kingfisher has about Rs 130 crore ($24.6 million) tax deducted at source (TDS) to be deposited with the government and has committed to pay it by the end of the current financial year to March 2012, junior finance minister SS Palanimanickam told parliament in a written reply to a question.

Kingfisher has about Rs 130 crore ($24.6 million) tax deducted at source (TDS) to be deposited with the government and has committed to pay it by the end of the current financial year to March 2012, junior finance minister SS Palanimanickam told parliament in a written reply to a question.

Rs 300 crore in black money unearthed in April-October, 2011-12

The Income Tax Department seized Rs 300 crore in black money, including cash and jewellery, during April-October, 2011-12, Parliament was informed today.

The I-T Department has issued 2,190 warrants and seized assets worth Rs 299.63 crore, Finance Minister Pranab Mukherjee said in the Rajya Sabha.

Of the total amount seized, Rs 179.59 crore was in cash, Rs 95.67 crore was jewellery and Rs 24.36 crore was in the form of other assets, he said.

During the 2010-11 fiscal, the I-T Department has seized assets worth Rs 774.98 crore by executing 4,852 warrants, Mukherjee said.

The I-T Department has issued 2,190 warrants and seized assets worth Rs 299.63 crore, Finance Minister Pranab Mukherjee said in the Rajya Sabha.

Of the total amount seized, Rs 179.59 crore was in cash, Rs 95.67 crore was jewellery and Rs 24.36 crore was in the form of other assets, he said.

During the 2010-11 fiscal, the I-T Department has seized assets worth Rs 774.98 crore by executing 4,852 warrants, Mukherjee said.

Merger bells ring for Mahindra Satyam, Tech Mahindra

Mahindra Satyam and Tech Mahindra, controlled by the Mahindra & Mahindra group, are close to appointing merchant bankers and accounting firms to value the two businesses for an eventual merger, two senior executives with direct knowledge of the development said.

The merger will enable the M&M group's technology business to become the sixth biggest software ser exporter after TCS, Infosys, Cognizant, Wipro and HCL Technologies. The combined entity is expected to have revenues of $2 billion.

The merger will enable the M&M group's technology business to become the sixth biggest software ser exporter after TCS, Infosys, Cognizant, Wipro and HCL Technologies. The combined entity is expected to have revenues of $2 billion.

New RBI rules that reduce trading limits of banks and companies

India's piecemeal steps to defend the rupee can do little more than slow its decline for now, and some of the measures risk hurting the currency in the long term. In particular, new RBI rules that reduce trading limits of banks and companies could have the unintended effect of hampering their ability to hedge, choking off market liquidity and driving a chunk of trading to offshore markets.

The rupee's weakness a drop of nearly 20 percent from July highs to a record low last week reflects the increasing doubts of foreign investors over the ability of India to tame high inflation, prop up falling growth and rein-in its large fiscal and current account deficits.

Citigroup expects rupee trading volumes to drop by 25 to 30 percent after measures implemented late last week.

The rupee's weakness a drop of nearly 20 percent from July highs to a record low last week reflects the increasing doubts of foreign investors over the ability of India to tame high inflation, prop up falling growth and rein-in its large fiscal and current account deficits.

Citigroup expects rupee trading volumes to drop by 25 to 30 percent after measures implemented late last week.

Monday 19 December 2011

Stock Trading Tips for 20 Dec 2011

Stock Trading Tips for 20 Dec 2011

| Scrip | Trigger | Price | Stop Loss | Target 1 |

|---|---|---|---|---|

| BAJFINANCE | BUY ABOVE | 639 | 633 | 656 |

| SELL BELOW | 626 | 632 | 610 | |

| BANKBARODA | BUY ABOVE | 687 | 681 | 700 |

| SELL BELOW | 673 | 679 | 659 |

Fuel 2050: Bye, Bye petrol

Conventional fuels are only bound to get more expensive, and that's where Dr Greg Offer comes into the picture. "In the short term, over the next decade, it will be hard for any new fuel sources to challenge our dependence on oil, except biofuels, but they have limits. However, in the long term, within 50 years, it appears to me that it is inevitable that electricity will take over. We don't have a choice, " he says. Buying that Rewa seems like a sound investment now.

Offer, who teaches at the Imperial College of London, states that the rise in oil prices is a straight offshoot of the developing world aspiring for the same level of mobility that the developed world enjoys. "In the long term, beyond 2020, we must shift to alternative fuels such as electricity (whether via batteries or hydrogen doesn't matter), or face declining living standards in richer countries and limits to development elsewhere.

Offer, who teaches at the Imperial College of London, states that the rise in oil prices is a straight offshoot of the developing world aspiring for the same level of mobility that the developed world enjoys. "In the long term, beyond 2020, we must shift to alternative fuels such as electricity (whether via batteries or hydrogen doesn't matter), or face declining living standards in richer countries and limits to development elsewhere.

Saudi billionaire Prince Alwaleed bin Talal buys $300-million stake in Twitter

Saudi billionaire Prince Alwaleed bin Talal, an investor in some of the world's top companies, on Monday unveiled a $300 million stake purchase in fast-growing microblogging site Twitter, gaining another foothold in the global media industry.

Alwaleed, a nephew of the Saudi king with a personal net worth estimated by Forbes magazine in March to be just below $20 billion, already owns a 7 percent stake in News Corp and plans to start a cable news channel.

The Twitter stake, bought jointly by Alwaleed and his Kingdom Holding Co investment firm, resulted from "months of negotiations," Kingdom said. Shares in Kingdom jumped 5.7 percent in early trade in Saudi Arabia as investors hailed a deal in what is seen as a high-growth sector.

Applying an $8 billion valuation figure for Twitter used by some analysts, the investment by Alwaleed and Kingdom amounts to a 3.75 percent stake.

Alwaleed, a nephew of the Saudi king with a personal net worth estimated by Forbes magazine in March to be just below $20 billion, already owns a 7 percent stake in News Corp and plans to start a cable news channel.

The Twitter stake, bought jointly by Alwaleed and his Kingdom Holding Co investment firm, resulted from "months of negotiations," Kingdom said. Shares in Kingdom jumped 5.7 percent in early trade in Saudi Arabia as investors hailed a deal in what is seen as a high-growth sector.

Applying an $8 billion valuation figure for Twitter used by some analysts, the investment by Alwaleed and Kingdom amounts to a 3.75 percent stake.

IIM Ranchi wraps up Summer Placements 2012 with 76 offers

IIM Ranchi has wrapped up its summer placements process with the 67-strong batch bagging 76 offers from 43 companies across banking & finance, sales & marketing, consulting, operations, general management and HR. Some niche profiles were in CSR, real estate and sports management. The process also saw participation from 28 new recruiters.

The diverse range of profiles on offer included financial consulting, strategy, hospitality management, IT consulting, statistics, and economic research apart from the regular profiles. The average stipend was around Rs 62,000 for two months with the highest stipend being Rs 160,000 offered by a market research firm based out of Malaysia. One student opted out of the process.

Around 43% of the batch bagged roles in banking and finance, where recruiters included Citigroup, JP Morgan, HSBC, Societe Generale, UAE Exchange, IL&FS, ICICI Bank and Yes Bank. Marketing and operations absorbed 38% in companies like Reckitt Benckiser, Hindustan Coca Cola Beverages, Britannia, Dabur, SABMiller and Berger Paints.

Some 11% of the batch also bagged offers in consulting, analytics and general management from recruiters like Ernst & Young, Capgemini Consulting and IBM. The remaining 8% bagged roles in HR, operations and project management.

The diverse range of profiles on offer included financial consulting, strategy, hospitality management, IT consulting, statistics, and economic research apart from the regular profiles. The average stipend was around Rs 62,000 for two months with the highest stipend being Rs 160,000 offered by a market research firm based out of Malaysia. One student opted out of the process.

Around 43% of the batch bagged roles in banking and finance, where recruiters included Citigroup, JP Morgan, HSBC, Societe Generale, UAE Exchange, IL&FS, ICICI Bank and Yes Bank. Marketing and operations absorbed 38% in companies like Reckitt Benckiser, Hindustan Coca Cola Beverages, Britannia, Dabur, SABMiller and Berger Paints.

Some 11% of the batch also bagged offers in consulting, analytics and general management from recruiters like Ernst & Young, Capgemini Consulting and IBM. The remaining 8% bagged roles in HR, operations and project management.

Anil Group forays into KSB segment, to invest 52 crore

Agri and food processing major Anil Group today said it has forayed into knowledge solution business (KSB) through a new venture- Ascent Knowledge Solutions (AKS)- in which, it will invest USD 10 million (Rs 52 crore) over the next one year.

AKS has set up a wholly owned subsidiary in US, Ascent Knowledge Solutions Inc (AKSI) and has taken on board two technocrats- Prof David Zimmy and Brad Waller- with expertise in IT and management consultancy to head US operations.

"Through this new venture, we are looking to tap USD 100 million market, out of the estimated USD 5 billion global market of IT-resource monitoring," Anil Group President HR Nalin Thakur told reporters.

"We shall be looking at a revenue of USD 10 million in next one year," Thakur said.

AKS will design and implement new technology-based activities worldwide with focus on SMEs in India and South Asia. It will also set up a network operation centre for development of India based operations.

AKS has set up a wholly owned subsidiary in US, Ascent Knowledge Solutions Inc (AKSI) and has taken on board two technocrats- Prof David Zimmy and Brad Waller- with expertise in IT and management consultancy to head US operations.

"Through this new venture, we are looking to tap USD 100 million market, out of the estimated USD 5 billion global market of IT-resource monitoring," Anil Group President HR Nalin Thakur told reporters.

"We shall be looking at a revenue of USD 10 million in next one year," Thakur said.

AKS will design and implement new technology-based activities worldwide with focus on SMEs in India and South Asia. It will also set up a network operation centre for development of India based operations.

HSBC Holdings PLC plans to cut upto 1200 jobs at its consumer banking unit in India

The job cuts are likely to affect a range of functions and are likely to be carried out in a phased manner, two people directly familiar with the banks plans said on condition of anonymity.

The planned cuts are in line with a decision announced by HSBC Chief Executive Stuart Gulliver in August this year in which he said the bank would cut 30,000 jobs globally by 2013 in a move to reduce costs.A spokesperson for HSBC in India said in response to emailed queries from ET NOW that they do not comment on market rumour.

An executive familiar with the planned exercise confirmed that a team from HSBC's Human Resources department is currently working with managers across functions in the consumer banking division to identify dispensable roles. "The job cuts could lead to a large number of layoffs but the bank would attempt to rehabilitate as many people as possible in different businesses such as the insurance vertical", the executive said.

The planned cuts are in line with a decision announced by HSBC Chief Executive Stuart Gulliver in August this year in which he said the bank would cut 30,000 jobs globally by 2013 in a move to reduce costs.A spokesperson for HSBC in India said in response to emailed queries from ET NOW that they do not comment on market rumour.

An executive familiar with the planned exercise confirmed that a team from HSBC's Human Resources department is currently working with managers across functions in the consumer banking division to identify dispensable roles. "The job cuts could lead to a large number of layoffs but the bank would attempt to rehabilitate as many people as possible in different businesses such as the insurance vertical", the executive said.

TCS to set up new campus in Nagpur for Rs 600 crore

The country's largest software exporter Tata Consultancy Services today said it will build a new software development unit in Maharashtra at an initial investment of Rs 600 crore, creating jobs for over 8,200 professionals.

The campus will be located at Nagpur, Maharashtra, in the Mihan Special Economic Zone ( SEZ), Tata Consultancy Services (TCS) said in a filing to the BSE.

"Nagpur has the potential to become the next big hub for knowledge-based industries like IT and engineering with its strong eco-system of universities, talented people and infrastructure," TCS CEO and MD N Chandrasekaran said.

The TCS Nagpur campus will be build in two phases, the first of which will contain 8,200 seats for IT services and BPO services. The second phase will be of similar scope, it said.

Once the project is completed, the campus will accommodate 16,000 associates, the filing added.Shares of TCS were trading at Rs 1,120.25 apiece on the BSE today, down 2.03 per cent from their previous close.

The campus will be located at Nagpur, Maharashtra, in the Mihan Special Economic Zone ( SEZ), Tata Consultancy Services (TCS) said in a filing to the BSE.

"Nagpur has the potential to become the next big hub for knowledge-based industries like IT and engineering with its strong eco-system of universities, talented people and infrastructure," TCS CEO and MD N Chandrasekaran said.

The TCS Nagpur campus will be build in two phases, the first of which will contain 8,200 seats for IT services and BPO services. The second phase will be of similar scope, it said.

Once the project is completed, the campus will accommodate 16,000 associates, the filing added.Shares of TCS were trading at Rs 1,120.25 apiece on the BSE today, down 2.03 per cent from their previous close.

Thursday 15 December 2011

Stock Trading Tips for 16 Dec 2011

Stock Trading Tips for 16 Dec 2011

| Scrip | Trigger | Price | Stop Loss | Target 1 |

|---|---|---|---|---|

| WIPRO | BUY ABOVE | 410 | 407 | 420 |

| SELL BELOW | 402 | 406 | 392 | |

| RANBAXY | BUY ABOVE | 387 | 384 | 397 |

| SELL BELOW | 380 | 383 | 370 |

Wednesday 14 December 2011

World's cheapest tablet Aakash goes on sale for Rs 2500 online

World's cheapest tablet Aakash goes on sale for Rs 2500 online

| Specifications | Aakash | UbiSlate 7 (The upgraded version of Aakash) |

| Availability | NOW! | Late January |

| Pricing | Rs.2,500 | Rs.2,999 |

| Microprocessor | Arm11 – 366Mhz | Cortex A8 – 700 Mhz |

| Battery | 2100 mAh | 3200 mAh |

| OS | Android 2.2 | Android 2.3 |

| Network | WiFi | WiFi & GPRS (SIM & Phone functionality) |

Features:

Unbeatable Price:

Only Rs.2,999 for the UbiSlate

Monthly internet charges: Rs.98 / 2GB

High Quality Web Anytime & Anywhere:

Connect via GPRS or WiFi

GPRS: Embedded modem eliminates the need for external dongles and allows Internet access

everywhere

WiFi: Allows fast Youtube videos at hotspots

Fast web access even on GPRS networks, across the country using DataWind’s patented acceleration

Fast web access even on GPRS networks, across the country using DataWind’s patented acceleration

Technology

Web, Email, Facebook, Twitter and much much more!

Multimedia Powerhouse:

HD Quality Video

Watching movies in the palm of your hand on a 7” screen

Audio library software helps manage your full collection of songs

Applications Galore with Android 2.2:

Games

Productivity software: Office suite

Educational software

Over 150,000 apps!

Full sized-USB port & Micro-SD slot:

Expand memory to 32GB

Use any ordinary pen-drive

Even plug-in a 3G dongle

And It’s a Phone!

The seven inch tablet with Android 2.2 is now available through its portal aakashtablet.com. "We have put up on sale about 30,000 tablets online, which will have a cash on delivery of 7 days. We have achieved pre-sale orders of about 400,000 tablets from individuals and corporates. But current supplies will only be limited for individual buyers," Datawind CEO and founder Suneet Singh Tuli told ET.

Aakash's next commercial version called the Ubislate 7, which has a faster processor, is slated to be launched late January. Ubislate 7 is set to have a 700 Mhz processor compared to the 366 MHz processor in Aakash. Ubislate 7 will be priced at Rs 3000 for sale online.

Datawind though seems to be struggling with customer service issues for online retail, even though the sale is only for a limited number of tablets.

According to sources, the Indian government is also planning to provide a new specification for Aakash, which may come with a faster processor and better battery life. The current version of Aakash has a battery life of about 1.5 hours. An email to the Ministry of Human Resource and Development, which is supplying the tablets to schools and colleges remained unanswered.

The government till now procured only 10,000 tablets. It has still not procured the remaining 90,000 tablets for distribution in schools and colleges, even as other nations have expressed interest to the government for similar low cost computing initiatives.

RBI data exceeds Commerce Ministry figures by $7.2 billion

the government lowered the April-October export numbers by $8.8 billion to $171 billion from $179.8 billion, citing human and computer errors for the original overstatement.

This revision, which largely pertained to the April-June quarter, had come after doubts were raised about excessively rosy export data in the backdrop of a global economy that was slowing down rapidly. But the discrepancy that has now arisen between the commerce department and Reserve Bank data could cause further embarrassment to the government.

The central bank's data is considered to be more reliable as it is based on actual payment basis. The government may, therefore, have to restate the revised figures again or find a plausible explanation to rule out the possibility of exports mis-pricing to bring back black money.

"The concerned officials are looking at the exports numbers again," said a government official, adding that another revision was possible. Unlike the first round, this time the revision will have to be in the upward direction if the export data has to be reconciled with the RBI figures.

This revision, which largely pertained to the April-June quarter, had come after doubts were raised about excessively rosy export data in the backdrop of a global economy that was slowing down rapidly. But the discrepancy that has now arisen between the commerce department and Reserve Bank data could cause further embarrassment to the government.

The central bank's data is considered to be more reliable as it is based on actual payment basis. The government may, therefore, have to restate the revised figures again or find a plausible explanation to rule out the possibility of exports mis-pricing to bring back black money.

"The concerned officials are looking at the exports numbers again," said a government official, adding that another revision was possible. Unlike the first round, this time the revision will have to be in the upward direction if the export data has to be reconciled with the RBI figures.

Rupee dropped to another record low versus the dollar

Rupee dropped to another record low versus the dollar on Thursday as concerns heightened slowing domestic growth will spur further capital outflows.

The partially convertible rupee hit an all-time low of 54.30 per dollar in early trading, taking losses to about 4 percent this week.

Asian markets fell for a third straight session and the euro sat at 11-month lows Thursday on growing doubts over last week's European debt deal as Germany warned the crisis would last for years.

And data in Japan highlighted the impact of the European crisis on the country's economy as the closely watched Tankan survey showed most manufacturers were pessimistic about the future.

Tokyo was 1.32 percent lower by the break, Hong Kong fell 2.36 percent, Sydney was 1.75 percent lower, Seoul shed 1.79 percent and Shanghai lost 1.55 percent.

The partially convertible rupee hit an all-time low of 54.30 per dollar in early trading, taking losses to about 4 percent this week.

Asian markets fell for a third straight session and the euro sat at 11-month lows Thursday on growing doubts over last week's European debt deal as Germany warned the crisis would last for years.

And data in Japan highlighted the impact of the European crisis on the country's economy as the closely watched Tankan survey showed most manufacturers were pessimistic about the future.

Tokyo was 1.32 percent lower by the break, Hong Kong fell 2.36 percent, Sydney was 1.75 percent lower, Seoul shed 1.79 percent and Shanghai lost 1.55 percent.

Stock Trading Tips for 15 Dec 2011

Stock Trading Tips for 15 Dec 2011

| Scrip | Trigger | Price | Stop Loss | Target 1 |

|---|---|---|---|---|

| HAVELLS | BUY ABOVE | 433 | 429 | 445 |

| SELL BELOW | 424 | 428 | 412 | |

| HINDPETRO | BUY ABOVE | 280 | 277 | 288 |

| SELL BELOW | 274 | 277 | 266 |

Monday 12 December 2011

India will spend upwards of Rs 60,000 crore over the next five years on developing military infrastructure

Defending long unresolved borders against two potentially hostile nuclear-armed neighbours does not come cheap. Besides, acquiring a wide array of weapon systems for billions of dollars, India will spend upwards of Rs 60,000 crore over the next five years on developing military infrastructure and capabilities for the western and eastern fronts.

If the cost of raising the already-sanctioned new mountain strike corps in the north-east is pegged at another Rs 60,000 crore and a conservative estimate of defense capital outlay in the 2012-2017 timeframe crossing Rs 4,00,000 crore are taken into account, it adds up to a staggering Rs 5,20,000 crore. This does not include the huge day-to-day cost of maintaining a 13-lakh armed forces.

Defence minister A K Antony on Monday gave figures for the planned development of military infrastructure, with new fighter bases, helipads, bunkers, forward ammunition dumps and the like, to strategically counter China and Pakistan.

Responding to queries on major projects of Military Engineer Services (MES) in Lok Sabha, Antony pegged the planned ``development'' of Army infrastructure and ``improvement'' of IAF infrastructure in the north-east at Rs 7,374 crore and Rs 1,753 crore, respectively.

Similarly, capability development along the northern borders will cost Rs 24,312 crore, while upgrade of storage facility for ammunition will come for Rs 18,450 crore.

Construction of suitable habitat for soldiers deployed in high-altitude areas like Kargil, Siachen-Saltoro Ridge and Ladakh, which includes insulation, dome and fibre-glass based shelters, will cost another Rs 6,000 crore.

If the cost of raising the already-sanctioned new mountain strike corps in the north-east is pegged at another Rs 60,000 crore and a conservative estimate of defense capital outlay in the 2012-2017 timeframe crossing Rs 4,00,000 crore are taken into account, it adds up to a staggering Rs 5,20,000 crore. This does not include the huge day-to-day cost of maintaining a 13-lakh armed forces.

Defence minister A K Antony on Monday gave figures for the planned development of military infrastructure, with new fighter bases, helipads, bunkers, forward ammunition dumps and the like, to strategically counter China and Pakistan.

Responding to queries on major projects of Military Engineer Services (MES) in Lok Sabha, Antony pegged the planned ``development'' of Army infrastructure and ``improvement'' of IAF infrastructure in the north-east at Rs 7,374 crore and Rs 1,753 crore, respectively.

Similarly, capability development along the northern borders will cost Rs 24,312 crore, while upgrade of storage facility for ammunition will come for Rs 18,450 crore.

Construction of suitable habitat for soldiers deployed in high-altitude areas like Kargil, Siachen-Saltoro Ridge and Ladakh, which includes insulation, dome and fibre-glass based shelters, will cost another Rs 6,000 crore.

Stock Trading Tips for 13 Dec 2011

Stock Trading Tips for 13 Dec 2011

| Scrip | Trigger | Price | Stop Loss | Target 1 |

|---|---|---|---|---|

| SBIN | BUY ABOVE | 1790 | 1775 | 1815 |

| SELL BELOW | 1755 | 1770 | 1724 | |

| SHRIRAMCIT | BUY ABOVE | 505 | 500 | 512 |

| SELL BELOW | 495 | 499 | 484 |

Friday 9 December 2011

Govt lowers GDP growth forecast to 7.5%

Citing global and domestic reasons, the government today lowered the GDP forecast for the current fiscal to 7.5 % from 9 %, but exuded confidence of a revival in the next year.

"The analysis of several data series and simple macro-econometric modeling lead us to forecast GDP growth of 7.5 % (plus/minus 0.25 %) during 2011-12," the government said in the Mid-Year Analysis 2011-12 tabled in Parliament.

Compounding with domestic factors like decline in industrial production, the global situation has led to a clear slowdown in the growth rate in the first half of 2011-12 to 7.3 % from 8.6 % year-on-year, it said.

"The analysis of several data series and simple macro-econometric modeling lead us to forecast GDP growth of 7.5 % (plus/minus 0.25 %) during 2011-12," the government said in the Mid-Year Analysis 2011-12 tabled in Parliament.

Compounding with domestic factors like decline in industrial production, the global situation has led to a clear slowdown in the growth rate in the first half of 2011-12 to 7.3 % from 8.6 % year-on-year, it said.

Stock Trading Tips for 12 Dec 2011

Stock Trading Tips for 12 Dec 2011

| Scrip | Trigger | Price | Stop Loss | Target 1 |

|---|---|---|---|---|

| FINANTECH | BUY ABOVE | 613 | 607 | 622 |

| SELL BELOW | 600 | 606 | 590 | |

| FEDERALBNK | BUY ABOVE | 392 | 389 | 402 |

| SELL BELOW | 385 | 388 | 375 |

Thursday 8 December 2011

Stock Trading Tips for 09 Dec 2011

Stock Trading Tips for 09 Dec 2011

| Scrip | Trigger | Price | Stop Loss | Target 1 |

|---|---|---|---|---|

| ABAN | BUY ABOVE | 357 | 354 | 367 |

| SELL BELOW | 350 | 354 | 340 | |

| ALCHEM | BUY ABOVE | 259 | 257 | 266 |

| SELL BELOW | 254 | 256 | 247 |

நூல் வெளியீடு - பங்குச் சந்தையில் பணம் பண்ண..!

பங்குச் சந்தை நிபுணர் ஜி. ரமேஷ் எழுதிய பங்குச் சந்தையில் பணம் பண்ண..! என்கிற பங்குச் சந்தை தொடர்பான டெக்னிக்கல் அனாலிசிஸ் நூல் வெளியீட்டு விழா தேவ நேய பாவாணர் அரங்கம்,

சென்னை 600002 -ல் நடந்தது.விழாவுக்கு வந்தவர்களை இந்நூலை வெளியிட்டிருக்கும் பெரிகாம் பதிப்பாசிரியர் க.ஜெயகிருஷ்ணன் வரவேற்றார்.

விழாவுக்கு ஏ.பி.ஜே. அக்வா ஃபார்ம்ஸ் நிறுவனத்தின் தலைவர் ஏ.பி.ஜே. குணசேகரன் தலைமை தாங்கினார். சிறப்பு விருந்தினராக டி.ஜே.எஸ். பொறியியல் கல்லூரி சேர்மன் டி.ஜே.கோவிந்தராஜன் பங்கேற்றார். முதல் பிரதியை வெளியிட்டு பேசிய சாய்ராம் பொறியியல் கல்லூரி மற்றும் கல்விக் குழுமத்தின் செயலாளர் மு. வாசு, பங்குச் சந்தை குறித்த முதல் தமிழ் டெக்னிக்கல் நூலை வெளியிடுவதில் பெருமை கொள்வதாக குறிப்பிட்டார்.

முதல் பிரதியை வருமான வரித் துறை துணை இயக்குநர் வி.நந்தகுமார், ஐ.ஆர்.எஸ் பெற்றுக் கொண்டார்.

பங்குச் சந்தை நிபுணர் எஸ். லெட்சுமணராமன், சன் டிவி மகாதேவன், நாணயம் விகடன் சரவணன் ஆகியோர் பாராட்டி பேசினார்கள்.அடுத்து நூலாசிரியர் ஜி.ரமேஷ் ஏற்புரை நிகழ்த்தினார். சன் டிவி வர்த்தக உலகம் நிகழ்ச்சி தொகுப்பாளர் ஆர்.ரெங்கராஜ் நன்றி கூறினார்.

சென்னை 600002 -ல் நடந்தது.விழாவுக்கு வந்தவர்களை இந்நூலை வெளியிட்டிருக்கும் பெரிகாம் பதிப்பாசிரியர் க.ஜெயகிருஷ்ணன் வரவேற்றார்.

விழாவுக்கு ஏ.பி.ஜே. அக்வா ஃபார்ம்ஸ் நிறுவனத்தின் தலைவர் ஏ.பி.ஜே. குணசேகரன் தலைமை தாங்கினார். சிறப்பு விருந்தினராக டி.ஜே.எஸ். பொறியியல் கல்லூரி சேர்மன் டி.ஜே.கோவிந்தராஜன் பங்கேற்றார். முதல் பிரதியை வெளியிட்டு பேசிய சாய்ராம் பொறியியல் கல்லூரி மற்றும் கல்விக் குழுமத்தின் செயலாளர் மு. வாசு, பங்குச் சந்தை குறித்த முதல் தமிழ் டெக்னிக்கல் நூலை வெளியிடுவதில் பெருமை கொள்வதாக குறிப்பிட்டார்.

முதல் பிரதியை வருமான வரித் துறை துணை இயக்குநர் வி.நந்தகுமார், ஐ.ஆர்.எஸ் பெற்றுக் கொண்டார்.

மேலே உள்ள படத்தில்:

பங்குச் சந்தை நிபுணர் ஜி.ரமேஷ் எழுதிய பங்குச் சந்தையில் பணம் பண்ண..! என்கிற தமிழின் முதல் டெக்னிக்கல் அனாலிசிஸ் நூலை சாய்ராம் பொறியியல் கல்லூரி மற்றும் கல்விக் குழுமத்தின் செயலாளர் மு. வாசு வெளியிட வருமான வரித் துறை துணை இயக்குநர் வி.நந்தகுமார், ஐ.ஆர்.எஸ் பெற்றுக் கொண்டார். அருகில் ஏ.பி.ஜே. அக்வா ஃபார்ம்ஸ் நிறுவனத்தின் தலைவர் ஏ.பி.ஜே. குணசேகரன், டி.ஜே.எஸ். பொறியியல் கல்லூரி சேர்மன் டி.ஜே.கோவிந்தராஜன், நூலாசிரியர் ஜி.ரமேஷ், பெரிகாம் பதிப்பாசிரியர் க.ஜெயகிருஷ்ணன் ஆகியோர் உள்ளார்கள்.பங்குச் சந்தை நிபுணர் எஸ். லெட்சுமணராமன், சன் டிவி மகாதேவன், நாணயம் விகடன் சரவணன் ஆகியோர் பாராட்டி பேசினார்கள்.அடுத்து நூலாசிரியர் ஜி.ரமேஷ் ஏற்புரை நிகழ்த்தினார். சன் டிவி வர்த்தக உலகம் நிகழ்ச்சி தொகுப்பாளர் ஆர்.ரெங்கராஜ் நன்றி கூறினார்.

Wednesday 7 December 2011

Govt puts FDI in retail on hold

The deadlock in Parliament over the government's decision to allow foreign direct investment (FDI) in retail ended on Wednesday after an all-party meeting passed a resolution to suspend the move till a consensus was reached.

Both Houses of Parliament functioned normally and took the crucial Question Hour for the first time since the Winter Session began November 22.

Finance Minister Pranab Mukherjee who chaired the meeting made a brief statement in the Lok Sabha and read out the resolution passed in the all-party meeting.

"The decision to permit 51 per cent FDI in retail trade is suspended till a consensus is developed through consultation among various stakeholders," a one-paragraph resolution passed in the meeting said.

Mukherjee said he was "glad" that all political parties have agreed. He said as per the government's latest formula, they would now consult all stakeholders, including the chief ministers of all states and political parties, before going ahead with the policy.

"The government will take a final decision through consultation. Let the houses conduct normal business."

Leader of Opposition Sushma Swaraj of the Bharatiya Janata Party (BJP) welcomed the decision and said it was not the defeat of the government "but it strengthened democracy".

She complimented the finance minster and Prime Minister Manmohan Singh who was present in the house. "I thank the finance minister and the prime minister," Sushma Swaraj said.

Earlier, leaders of political parties emerging out of the meeting said they have agreed on the government's formula to suspend foreign investment in retail.

The issue had led to a continuous logjam in Parliament as both houses were not been able to run since the Winter Session began. There were other issues, including rising prices, Telangana and corruption, that blocked Parliament for the first nine days of the session.

Calling it "peoples' victory", the Communist Party of India (CPI) said the government has virtually revoked the FDI decision.

"It is a virtual rollback. I compliment the government for taking a belated decision. It has been retreated," CPI leader Gurudas Dasgupta told reporters.

He said the government would consult on the issue and when "they will come to us, we will oppose it again. There will be no consensus and it won't be implemented," Dasgupta said.

He said both the Houses will function normally now.

Trinamool Congress, a bitter critic of the policy and a ruling Congress ally in the United Progressive Alliance (UPA), said every political party, "including the Bharatiya Janata Party (BJP)", agreed to let Parliament function and put the FDI decision on hold.

Both Houses of Parliament functioned normally and took the crucial Question Hour for the first time since the Winter Session began November 22.

Finance Minister Pranab Mukherjee who chaired the meeting made a brief statement in the Lok Sabha and read out the resolution passed in the all-party meeting.

"The decision to permit 51 per cent FDI in retail trade is suspended till a consensus is developed through consultation among various stakeholders," a one-paragraph resolution passed in the meeting said.

Mukherjee said he was "glad" that all political parties have agreed. He said as per the government's latest formula, they would now consult all stakeholders, including the chief ministers of all states and political parties, before going ahead with the policy.

"The government will take a final decision through consultation. Let the houses conduct normal business."

Leader of Opposition Sushma Swaraj of the Bharatiya Janata Party (BJP) welcomed the decision and said it was not the defeat of the government "but it strengthened democracy".

She complimented the finance minster and Prime Minister Manmohan Singh who was present in the house. "I thank the finance minister and the prime minister," Sushma Swaraj said.

Earlier, leaders of political parties emerging out of the meeting said they have agreed on the government's formula to suspend foreign investment in retail.

The issue had led to a continuous logjam in Parliament as both houses were not been able to run since the Winter Session began. There were other issues, including rising prices, Telangana and corruption, that blocked Parliament for the first nine days of the session.

Calling it "peoples' victory", the Communist Party of India (CPI) said the government has virtually revoked the FDI decision.

"It is a virtual rollback. I compliment the government for taking a belated decision. It has been retreated," CPI leader Gurudas Dasgupta told reporters.

He said the government would consult on the issue and when "they will come to us, we will oppose it again. There will be no consensus and it won't be implemented," Dasgupta said.

He said both the Houses will function normally now.

Trinamool Congress, a bitter critic of the policy and a ruling Congress ally in the United Progressive Alliance (UPA), said every political party, "including the Bharatiya Janata Party (BJP)", agreed to let Parliament function and put the FDI decision on hold.

Stock Trading Tips for 08 Dec 2011

Stock Trading Tips for 08 Dec 2011

| Scrip | Trigger | Price | Stop Loss | Target 1 |

|---|---|---|---|---|

| TATASTEEL | BUY ABOVE | 421 | 417 | 431 |

| SELL BELOW | 413 | 417 | 403 | |

| PATNI | BUY ABOVE | 454 | 450 | 462 |

| SELL BELOW | 445 | 449 | 435 |

Tuesday 6 December 2011

2012 expected to be tough for markets

Bank of America Merill Lynch (BofAML) expects tough market conditions to persist over the next six months and the Sensex to correct to 14,500 as growth concerns take centre-stage. However, the brokerage has set a target of 19,000 for the year-end. “The good news is that we could get some positive returns in 2012 if policymakers take steps to reverse the economic slowdown such as aggressive rate cuts by RBI. Markets typically rally 3-6 months after the rate-cut cycle starts,” said a recent India Strategy report brought out by the brokerage.

Citi has set a target of 18,400 for the Sensex at a 1-year forward price-to-earnings multiple of 14x, a 10%.discount to the long-term average. Citi’s equity strategy report hit a note of optimism by stating that “inflation is statistically set to go down, interest rates will not continue to rise as demand falls, and the government has recently done more than in two years. Valuations are relatively attractive and earnings growth has been cut almost as sharply as in 2008”.

Morgan Stanley, on the other hand, has set a probability-weighted one-year target of 18,741 for the Sensex, 16% above the current level. “Valuations are attractive on an absolute basis and, market positioning, as evidenced by our proprietary sentiment indicator, is bearish. Together with the collapse in earnings revisions, this sets up the market for an upward move in 2012. The market’s P/B is implying a long-term return of 16%, which we think is a good return in the context of India’s equity risk premium,” stated a recent research report brought out by the brokerage.

BofAML expects India’s FY13 GDP growth to slow to 6.8% on the back of a slowing global economy, high interest rates and slowing investment spend. Earnings downgrades are likely to continue as well, led by slowing sales and sustained margin pressure from rising labour and interest costs.

According to Morgan Stanley, the government’s policy hiatus coupled with fiscal and current account deficits could pose problems for India. “A global crisis could cause the fiscal deficit to rise. This could imply that yields may stay higher for longer with negative implications for equities,” the broker’s report said. It further observes that the current account deficit could cause currency underperformance and have a negative effect on macro growth and corporate balance sheets. “We know from 2008-09 that while Indian earnings outperformed the world, its equity markets significantly underperformed for this very reason.”

Citi has set a target of 18,400 for the Sensex at a 1-year forward price-to-earnings multiple of 14x, a 10%.discount to the long-term average. Citi’s equity strategy report hit a note of optimism by stating that “inflation is statistically set to go down, interest rates will not continue to rise as demand falls, and the government has recently done more than in two years. Valuations are relatively attractive and earnings growth has been cut almost as sharply as in 2008”.

Morgan Stanley, on the other hand, has set a probability-weighted one-year target of 18,741 for the Sensex, 16% above the current level. “Valuations are attractive on an absolute basis and, market positioning, as evidenced by our proprietary sentiment indicator, is bearish. Together with the collapse in earnings revisions, this sets up the market for an upward move in 2012. The market’s P/B is implying a long-term return of 16%, which we think is a good return in the context of India’s equity risk premium,” stated a recent research report brought out by the brokerage.

BofAML expects India’s FY13 GDP growth to slow to 6.8% on the back of a slowing global economy, high interest rates and slowing investment spend. Earnings downgrades are likely to continue as well, led by slowing sales and sustained margin pressure from rising labour and interest costs.

According to Morgan Stanley, the government’s policy hiatus coupled with fiscal and current account deficits could pose problems for India. “A global crisis could cause the fiscal deficit to rise. This could imply that yields may stay higher for longer with negative implications for equities,” the broker’s report said. It further observes that the current account deficit could cause currency underperformance and have a negative effect on macro growth and corporate balance sheets. “We know from 2008-09 that while Indian earnings outperformed the world, its equity markets significantly underperformed for this very reason.”

LIC to float first infra debt fund(IDF)

Life Insurance Corporation of India (LIC) along with Srei Infrastructure Finance will float the country's first infrastructure debt fund (IDF), under a government scheme aimed at boosting investments in sectors like roads, seaports, airports and power.

The IDF scheme was announced in Budget this year. In June, Sebi came out with norms for these funds to be set up through the mutual funds route. Recently, the RBI laid down the guidelines for infra debt funds as NBFCs.

A senior official told FE that the government was keen to set up the first IDF by January. LIC is in talks with Sebi to get the approval for a debt fund, which will be a mutual fund, the official said.

As per norms of the IRDA (Insurance Regulatory and Development Authority), insurers are allowed to invest only in AAA and AA rated debt papers in the infrastructure sector.

Hemant Kanoria, CMD, Srei confirmed the development. Kanoria said, “Recently, Srei has got an in-principal approval from Sebi to set up a mutual fund. The market regulator has approved the trustees.

The IDF scheme was announced in Budget this year. In June, Sebi came out with norms for these funds to be set up through the mutual funds route. Recently, the RBI laid down the guidelines for infra debt funds as NBFCs.

A senior official told FE that the government was keen to set up the first IDF by January. LIC is in talks with Sebi to get the approval for a debt fund, which will be a mutual fund, the official said.

As per norms of the IRDA (Insurance Regulatory and Development Authority), insurers are allowed to invest only in AAA and AA rated debt papers in the infrastructure sector.

Hemant Kanoria, CMD, Srei confirmed the development. Kanoria said, “Recently, Srei has got an in-principal approval from Sebi to set up a mutual fund. The market regulator has approved the trustees.

Subscribe to:

Posts (Atom)